The economy has certainly been on the minds of busy owners in recent years.

So, I thought it might be useful to share my observations on where the Australian economy is at.

I’m fortunate to see different business owners in diverse industries each day which I like to think of as rolling R&D.

Here’s my take on the local economy based on my experience and the observations shared by many business owners.

Business owners feel they are working harder for the same or less profit. There is no easy money.

Rent, overhead expenses and direct costs are growing while margins are hard to hold. Customers are savvier and price sensitive.

With wage growth flat, employees are moving more to negotiate higher wages. Retention is a challenge.

There are talent shortages in many areas and attracting talent is challenging. Business owners are adopting more creative search and remuneration models to either retain existing talent or displace new talent from other employers.

Expectations and demands of younger worker seem to be at odds with Gen X and Boomer owners. A willingness of employees to tackle employers on their conditions and rights has created more conflict in employer/employee relations. As a result of this, a reluctance to hire staff is evident in the mindset of many business owners. The gap widens.

While interest rates are at historically low levels, access to finance has never been tighter. Prudential regulations and the royal commission have changed the game. The unexpected royal commission recommendation impacting mortgage brokers may further worsen the credit squeeze.

Falling property prices and concerns over future government policy on property taxation has caused widespread anxiety.

The domestic share market has been flat for over a decade with growth lagging behind international markets. The opposition government policy on capital gains tax and franking credits has created concerns around its impact on share market investment.

The gig economy continues to spread its wings with more workers subject to low pay and lack of regulation. We are yet to see the psychological and economic impact of thousands of contractors with no job security, below parity pay and poor working conditions. The class gap widens.

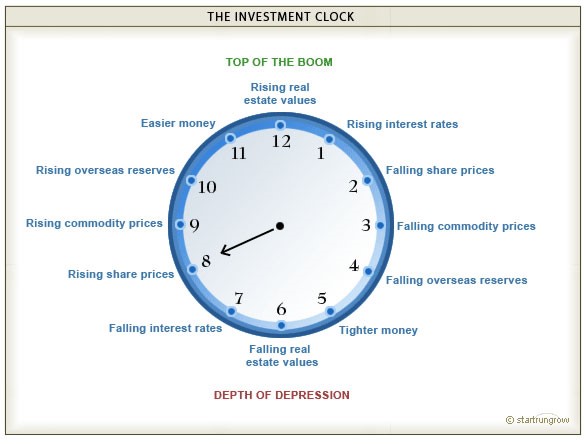

Observing all of this led me to recall the Investment Clock from economics at university. The clock graphically illustrates the economic cycles and remains relevant.

It is included for you to consider where we are.

I would argue we are precariously placed somewhere between 5 o’clock and 7 o’clock.

As I like to be a realist with optimist leanings, it would not surprise me if we continued the flat cycle we are in for some time. Or we could even dip into recession.

Let’s hope the Investment Clock strikes 12 for us in the not too distant future!